Guiding Principles

Integrity and honesty are at the heart of who we are.

Our ESG policies and approach are built on international conventions, standards and guidelines. Our Code of Conduct is based on the UN Global Compact, and our Responsible Investment Policy is based on the United Nations Principles for Responsible Investment (PRI).

Read our Responsible Investment Policy here

Open in browser

Reporting of Concerns

Click here to report concerns in our Electronic Whistleblower Channel

The UN Principles for Responsible Investment

In 2005, our Senior Advisor and former Chairperson, Knut Kjær, was among those invited by the UN Secretary at that time, Kofi Annan, to draft the UN Principles for Responsible Investment (PRI). FSN Capital has been a signatory of the PRI since 2012.

Adhering to UN PRI’s six principles is a natural part of our investment approach and the foundation for our Responsible Investment Policy. We highly welcome how PRI continues to drive the sustainable investment agenda, the PRI climate module being the latest development.

We have highlighted some of our key efforts to fulfill our commitments under each of PRI’s principles.

FSN Capital Partners’ PRI transparency reports are publicly available on UN PRI’s website.

Signatory of:![]()

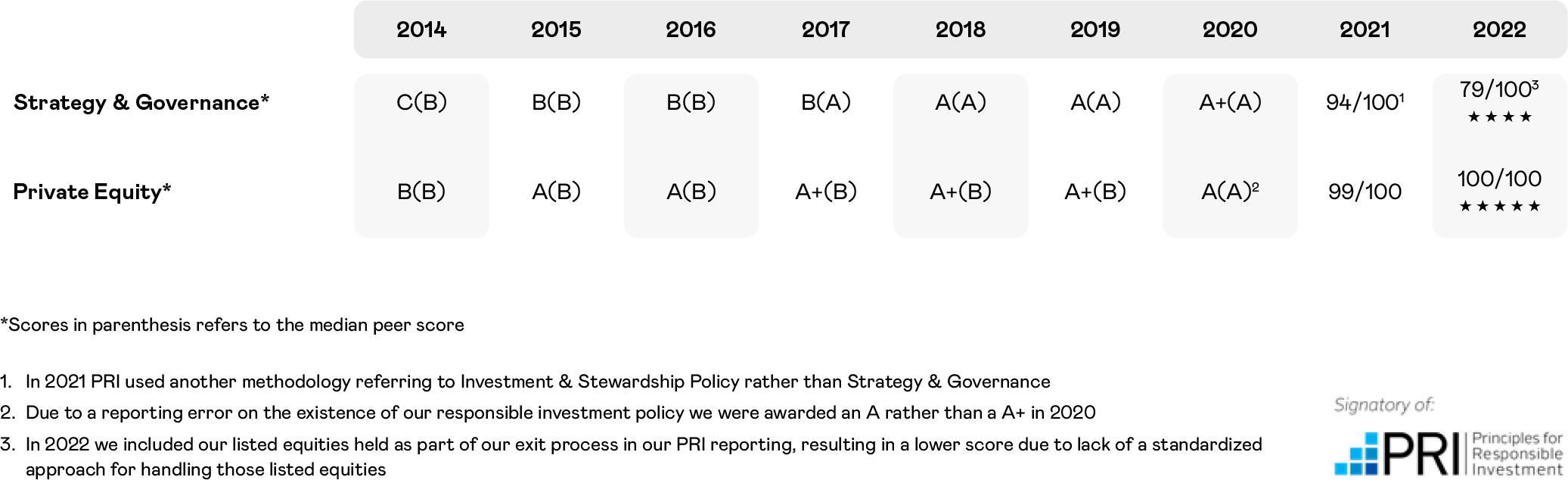

Historic PRI scores

The UN Sustainable Development Goals

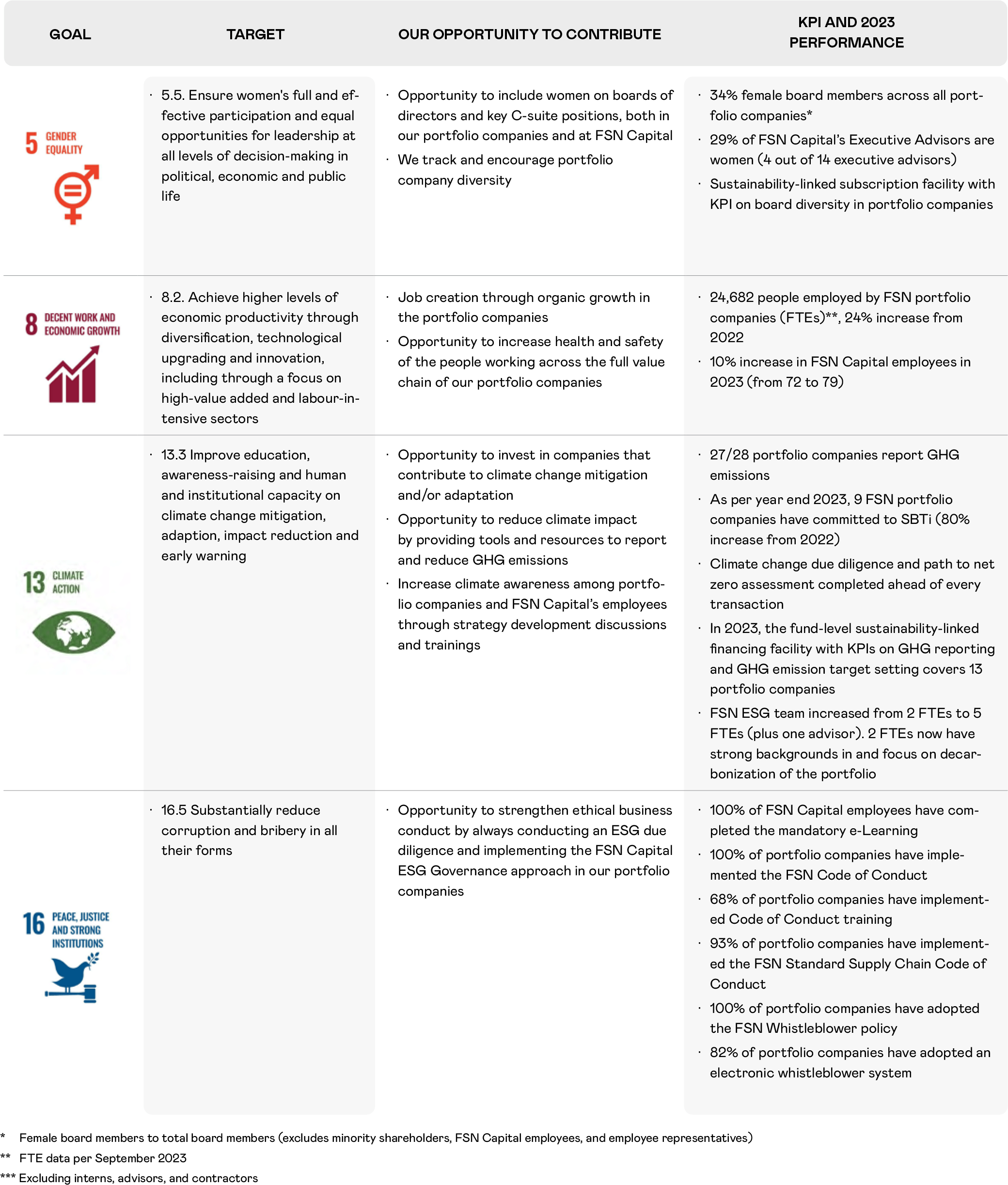

The private sector plays an integral part in solving the most urgent global challenges as best described by the UN Sustainable Development Goals (SDGs).

Since 2017, the UN SDGs have been part of how we engage with portfolio companies on ESG. Similarly, for our firm, we have identified the below SDGs and targets to which FSN Capital can contribute.

The Ten Principles of the UN Global Compact

FSN Capital Partners’ Code of Conduct clearly states that we shall respect The Ten Principles of the UN Global Compact in our business operations.

The standard code of conduct for Portfolio Companies under our ESG Governance Framework also includes these principles.

HUMAN RIGHTS

Principle 1: Businesses should support and respect the protection of internationally proclaimed human rights; and

Principle 2: Make sure that they are not complicit in human rights abuses.

LABOUR

Principle 3: Businesses should uphold the freedom of association and the effective recognition of the right to collective bargaining;

Principle 4: The elimination of all forms of forced and compulsory labour;

Principle 5: The effective abolition of child labour; and

Principle 6: The elimination of discrimination in respect of employment and occupation.

ENVIRONMENT

Principle 7: Businesses should support a precautionary approach to environmental challenges;

Principle 8: Undertake initiatives to promote greater environmental responsibility; and

Principle 9: encourage the development and diffusion of environmentally friendly technologies.

ANTI–CORRUPTION

Principle 10: Businesses should work against corruption in all its forms, including extortion and bribery.