Responsible Investing

As Private Equity investment advisors, we apply a long-term perspective when evaluating potential investment opportunities. Our goal is to identify companies that we believe are best positioned to capitalize on emerging trends at sector level, and to avoid stranded assets. We will prioritize investment opportunities that have tailwinds from major macro trends. When looking for new companies to invest in, ESG matters are always considered.

ESG is an integrated part of the investment analysis and decision-making process

- Our Responsible Investment Policy defines our formal exclusion criteria.

- We conduct a climate change due diligence in every transaction.

- We conduct an ESG due diligence in every transaction.

- A summary of the key risks and opportunities identified in the climate and ESG due diligence is always included in the investment decision material.

- We always consider the likely impact of key ESG and sustainability risks on return by having ESG risks integrated into our Risk Framework.

FSN Capital Exclusion Criteria

Our Responsible Investment Policy defines our formal exclusion criteria, stating we shall not invest in companies that:

- Have contributed to systematic denial of human rights

- Demonstrate a pattern of non-compliance with environmental regulations

- Show a pattern of engaging in child labor or forced labor

- Have an unacceptable high greenhouse gas footprint and have failed to take reasonable steps to reduce these emissions

- Produce weapons that through their normal use may violate fundamental humanitarian principles (e.g. anti-personnel land mines, production of cluster munitions, production of nuclear arms)

- Are directly related to adult entertainment, tobacco, gambling or alcohol

Climate change due diligence

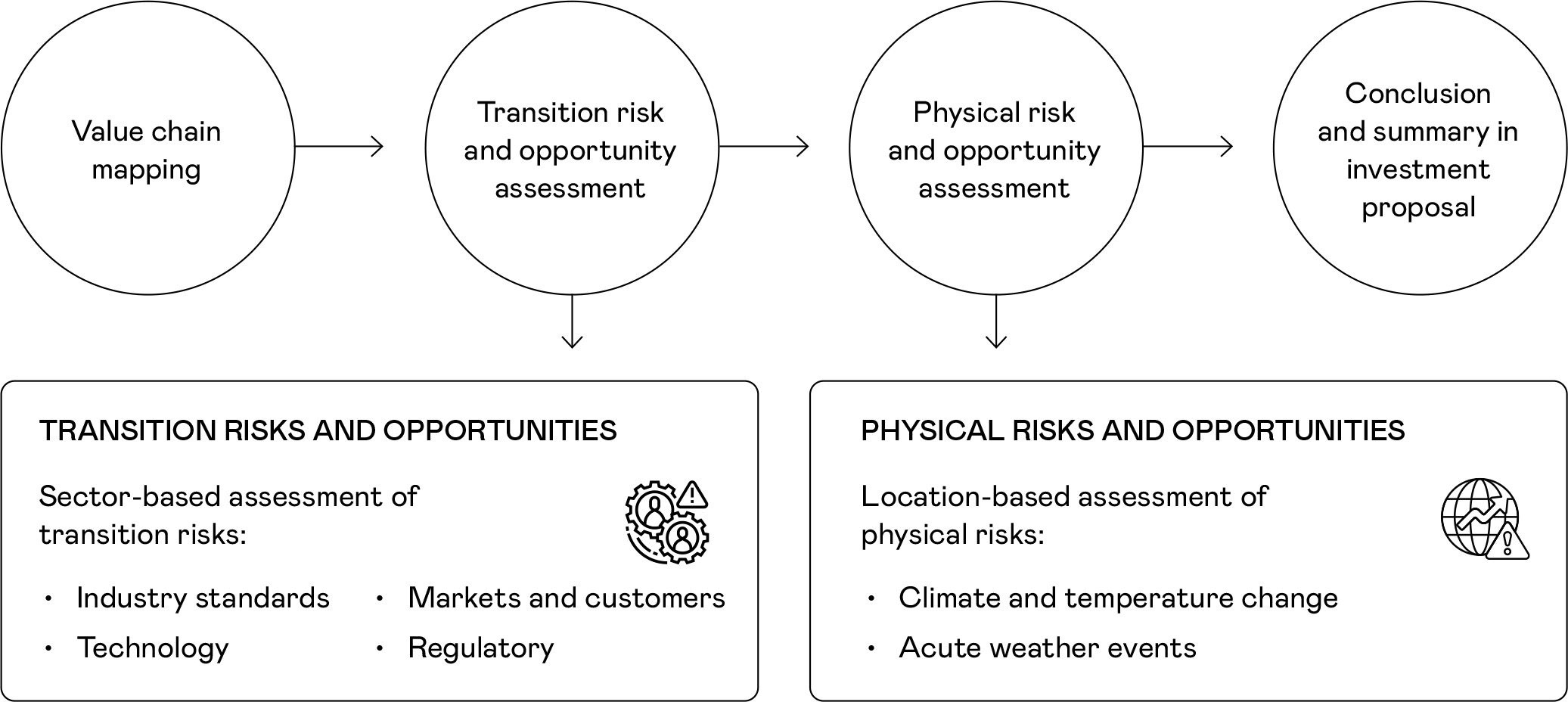

A standard requirement in all our transactions is that the deal team conduct a high-level climate change due diligence early in the investment phase. This is intended to ensure we uncover potential climate risks and opportunities to avoid stranded assets and capture investment opportunities.

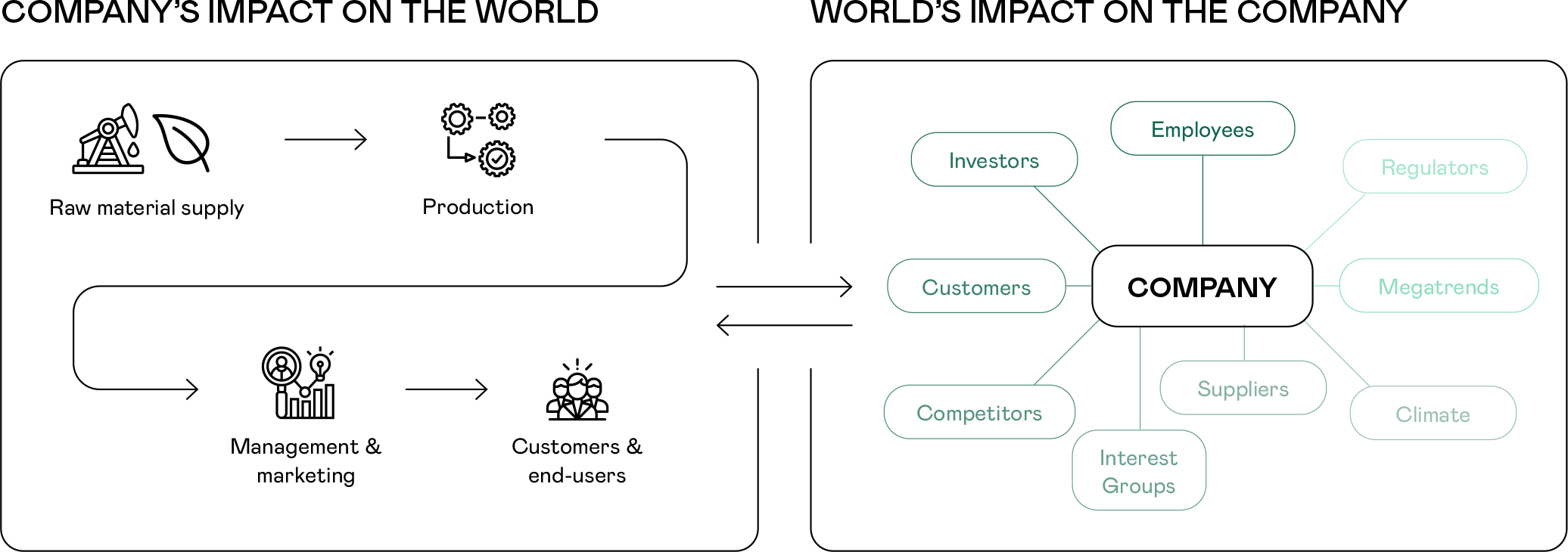

Our climate change due diligence evaluates transition and physical risks and opportunities along all stages of the company’s value chain. Transition risks and opportunities are assessed based on sector-specific properties, while physical risks and opportunities are assessed based on the geographical reach of the company’s value chain.

ESG due diligence

Our ESG due diligence, conducted by external experts, is a standard requirement for all potential investments that reach the Preliminary Investment Decision stage.

The objective of the ESG DD is threefold: (i) to identify potential “show-stoppers”; (ii) to ensure that ESG risks and opportunities are included in the pricing considerations and transaction documentation; and (iii) to identify the status quo and use this as a baseline in planning for the onboarding and continuous improvement during the ownership phase.

Our risk based ESG DD is designed to understand the residual ESG risks in any company. We ask external experts to report on the objective inherent risk in key categories, e.g., the company’s industry, jurisdictions, suppliers, and customers, and to analyse how the target company is currently addressing these risks. Finally, the experts document the residual risks and provide recommendations for how to address them to meet best practice in the ownership period.

Moritz Madlener, Investment Manager, on how ESG screening and due diligence supports the larger FSN Capital investment process

Net Zero Assessment

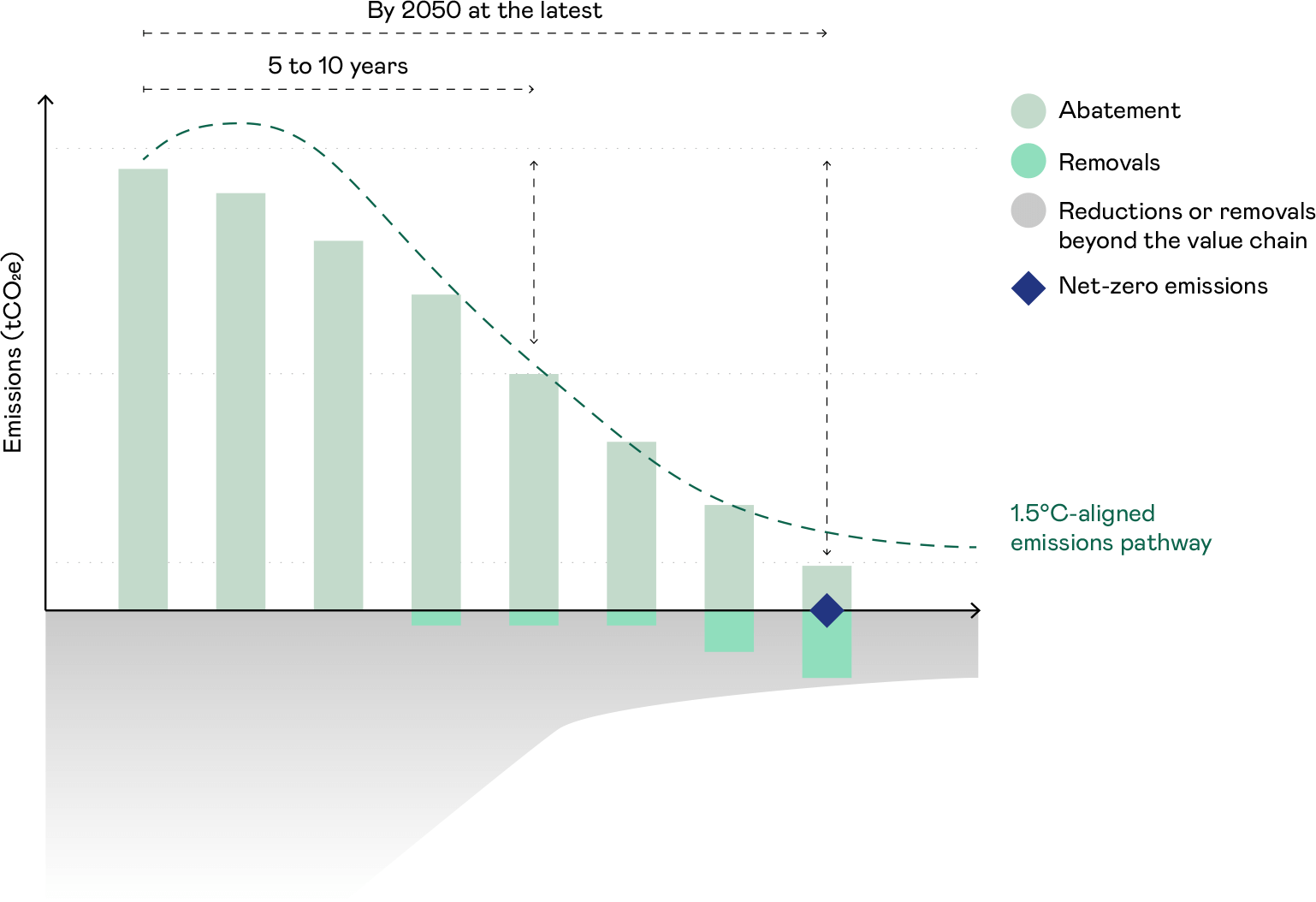

As part of FSN Capital’s Science-based Targets, we have committed to support our portfolio companies in setting their own Science-based Targets with the goal of driving FSN’s portfolio to Net Zero. We want to understand already in the due diligence phase (i) the commercial value of setting Science-based Targets, and (ii) how a potential investment’s GHG emissions can be reduced during our ownership period.

In every transaction we complete a high-level outside-in assessment of the commercial value of Net Zero initiatives, consider risks of not decarbonizing, and develop a company’s path to Net Zero through identifying:

· the most material sources of GHG emissions in the company’s value chain

· how to reduce the most material GHG emissions

· level of effort and costs of reaching Net Zero

FSN Capital’s Risk Categories

The FSN Capital Risk Framework is used for detailed analysis of alpha and beta risks in a due diligence process. Alpha risks can be managed actively by our guidance, while beta risks are beyond our control.

We always consider the likely impact of key ESG and sustainability risks on return by having ESG risks integrated in our Risk Framework.